Stop Wasting Hours on Manual GST Reconciliation. Automate it in Minutes with Our Excel Tool!

Are you tired of the tedious, error-prone process of manually matching your sales register with E-Invoice data from the GST portal? The endless VLOOKUPs, manual ticking, and the constant fear of compliance mistakes can drain your productivity and expose your business to risk.

Excel Utilities presents the ultimate solution: The Sales Register v/s E-Invoice Reconciliation Tool, a powerful, one-click Excel utility meticulously engineered for Chartered Accountants, Tax Consultants, and business owners across India who demand accuracy, speed, and peace of mind.

The Hidden Costs of Manual Reconciliation

Without automation, the reconciliation process is more than just an inconvenience, it's a significant drain on resources and a source of constant operational stress. If you're managing GST compliance manually, these challenges will sound all too familiar:

Enormous Time Commitment: Manually matching hundreds or thousands of invoices is an incredibly slow, line-by-line process that consumes days of valuable man-hours every month. This is time that could be spent on strategic financial planning, client acquisition, or business growth.

High Risk of Costly Human Error: A single typo, a missed invoice, or an incorrect formula in a complex spreadsheet can lead to inaccurate financial reports. These small mistakes can cascade into serious compliance issues, resulting in incorrect GST filings.

Lack of Financial Clarity: When discrepancies arise, it's difficult to get a clear, high-level view of the problem. Identifying why a particular invoice doesn't match often turns into a frustrating investigation, involving cross-referencing multiple files and reports.

Significant Compliance Risk: Inaccurate reconciliation is a direct path to incorrect GSTR-1 filings. This not only damages your credibility but can attract unwanted attention from tax authorities, leading to potential notices, interest charges, penalties, and even audits.

Say Goodbye to Reconciliation Headaches

Our tool is designed to systematically eliminate the biggest challenges you face, transforming your reconciliation workflow from a liability into an asset.

Eliminate Costly Manual Errors: Our tool automates data validation and comparison, removing the risk of human error. Sleep well knowing your numbers are accurate, down to the last paisa.

Reclaim 95% of Your Time: Slash your reconciliation time from hours or even days to under 5 minutes. Free up your team to focus on strategic initiatives instead of monotonous data entry.

Gain Unprecedented Financial Clarity: The interactive dashboard provides a bird's-eye view of your entire sales landscape. Instantly see matched, mismatched, and missing invoices, allowing you to make informed business decisions with confidence.

Achieve Rock-Solid GST Compliance: File your GSTR-1 returns with absolute certainty. Our tool ensures your books of accounts and the GST portal are in perfect sync, safeguarding you from compliance issues.

How It Works: A Deep Dive into 3 Simple Steps

Our tool is incredibly intuitive and powerful. You don't need to be an Excel VBA expert to harness its full potential

Step 1: Prepare and Import Your Data with Confidence Begin by navigating to the dedicated Sales Reg. sheet. Here, you'll paste your complete sales data from your accounting software (like Tally, Zoho, etc.). Before you proceed, we highly recommend using the built-in Validate Data button. This powerful feature acts as your first line of defense, proactively scanning your data for common errors like invalid GSTIN formats, incorrect dates, or missing mandatory fields, ensuring your data is clean from the start.

Next, click the IMPORT E-INV button on the main dashboard. You can then select one or even multiple E-Invoice reports downloaded from the portal. The tool will automatically open, read, and consolidate all the data into the E-Invoice sheet, standardizing formats and preparing it for a flawless comparison.

Step 2: Reconcile Thousands of Invoices with a Single Click Once your data is loaded, the magic happens. Simply press the main RECONCILE button on the dashboard. Our intelligent VBA engine instantly gets to work, comparing thousands of records in mere seconds. It meticulously matches invoices based on key fields like the document number, document date, recipient GSTIN, and all financial values (Taxable Value, IGST, CGST, SGST, and CESS), identifying every single match and discrepancy with unparalleled precision.

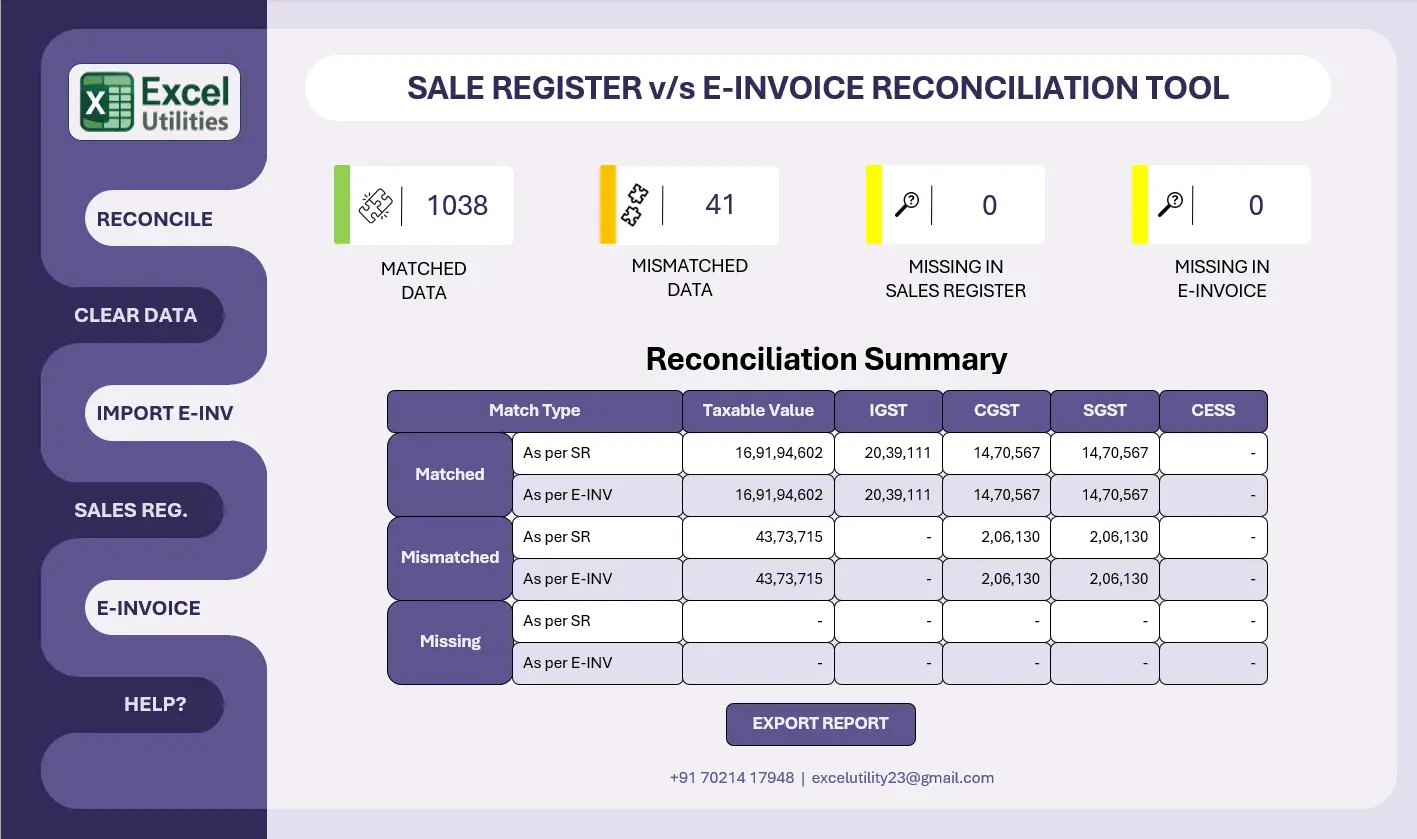

Step 3: Analyze Rich Insights and Export Your Report Instantly, the dashboard comes to life with a clear, high-level summary of your reconciliation status. For a deeper analysis, navigate to the Remarks column in the data sheets. This is where you get granular details, such as "Mismatch in Taxable Value, IGST" or "Missing in E-Invoice." This actionable insight allows you to pinpoint issues immediately. When your review is complete, click the EXPORT REPORT button to generate a clean, professional summary in a new Excel file, perfect for your internal records, audits, or for sharing with clients.

Dashboard View

Features That Empower Your Business

This isn't just a spreadsheet; it's a complete reconciliation powerhouse packed with features designed for professionals.

One-Click Reconciliation: Our advanced VBA engine performs a full, multi-threaded reconciliation with a single click, handling large volumes of data effortlessly.

Intelligent Data Validation: Before reconciliation, the tool cleans and validates your sales data, checking for invalid dates, missing fields, incorrect invoice formats, and document numbers exceeding the 16-character limit.

Bulk E-Invoice Import: Save immense time by importing and consolidating multiple E-invoice Excel files from the portal at once. The tool intelligently reads various sheet names like 'b2b', 'cdnr', and 'exp'.

Interactive Summary Dashboard: The clean, visual dashboard provides a high-level overview of matched, mismatched, and missing data, complete with financial totals for each category.

Granular Mismatch Reporting: The tool doesn't just tell you there's a mismatch; it tells you exactly why (e.g., "Mismatch in Taxable Value, IGST," "Mismatch in Document Date"), saving you hours of investigative work.

Automated Credit Note Handling: The tool automatically detects credit notes and converts their financial values to negative, ensuring mathematically perfect reconciliation without manual intervention.

Professional Report Export: Generate a clean, ready-to-share Excel report of the reconciled data for your clients, management, or audit records with a single click.

Who is This Tool For?

This tool is a must-have for anyone dealing with the complexities of GST compliance in India:

Chartered Accountants (CAs) and CA Firms looking to increase efficiency and accuracy while managing multiple clients.

Tax Consultants and Practitioners who need a reliable tool to deliver fast and accurate reconciliation reports.

Corporate Accounts Managers and Finance Teams responsible for internal GST compliance and reporting.

Small and Medium Business Owners who handle their own accounting and need a simple yet powerful solution to stay compliant.

- GST and Indirect Tax Professionals.

Download Your Free Demo Today!

Still not convinced? See the power of automation for yourself. Download a free, feature-limited demo version to experience just how easy GST reconciliation can be.

Click Here to download a Free Demo

Ready to unlock the full potential, eliminate risk, and save countless hours? Purchase the full version now and revolutionize your reconciliation process forever.

Top questions answered

We’ve answered some of the questions you might have in mind.

The tool comes with a pre-defined template in the "Sales Reg." sheet. You simply need to copy and paste your sales data from your accounting software (like Tally, Zoho, Busy, etc.) into the provided columns.

The tool's reconciliation engine is smart. It automatically groups all line items that share the same invoice number and sums up their values (taxable value, IGST, CGST, etc.) before making the comparison. This ensures an accurate, document-level reconciliation.

If the validator finds errors, it will unhide a 'Remarks' column in the "Sales Reg." sheet. This column will tell you exactly what is wrong with each specific row (e.g., "Invalid date format," "Missing required field"). Simply correct the highlighted errors and run the validation again until you get the success message.

Customers testimonials

What our customers are saying about us.